Fastest Growing Economy in the World

Highest GDP growth rate in the world. India is likely to become the world's second-largest economy by 2030,next only to China and overtaking the US, according to Standard Chartered's long-team forecast released on Jan.08

Stable Currency, helps with diversification

Rupee has performed exceptionally well against the dollar as compared to other currencies

Invest in india to diversify your investment

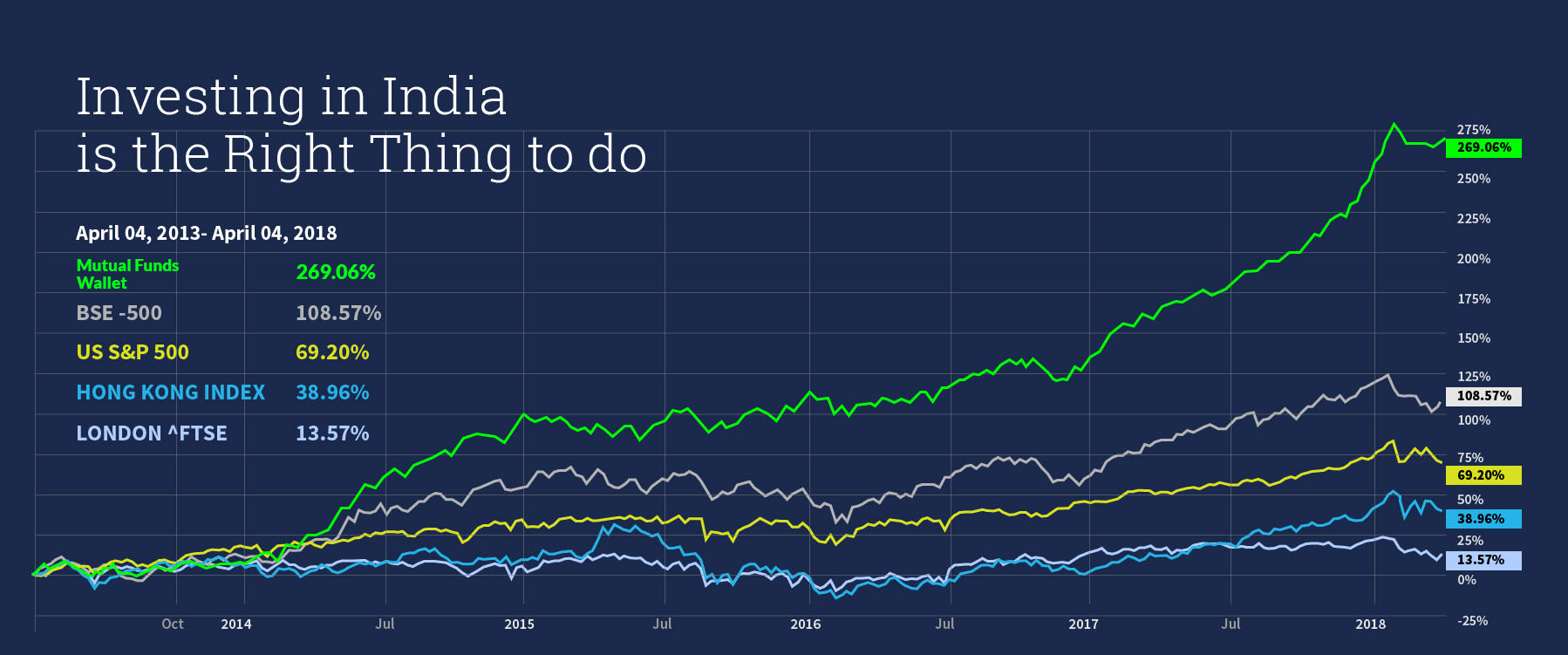

Booming Stock Market Capitalization

Market Capitalization expected to grow 3-4 times by 2025

Mutual Funds AUM expected to increase 7 times in the next 8 years

Reaping the rich Demographic Dividend

Fastest growing consumer Market

Rising incomes fuel demand for goods and services

Experts in NRI taxation, wealth management, banking rules, and overseas investments hacks. I had invested with Globvest, and has made reasonably well profits. I hold Mr. Aashish Aggarwal in high esteem and recommend him highly for investment advisory services.

Had lot of ambiguity in investments in india as an NRI, people at MFW made it transparent and crystal clear. Made my first ever investment through Globvest. It was easy and extremely smooth process. Great and expert funds advisory. You guys rocks!

Gone are the days when investing in Indian Mutual Funds was painful due to tedious paperwork, offline investments, redemptions and tracking.

Not Anymore.

INVEST Anytime!

Redeem Anytime!

It’s just like a walk in the park!

Simply register on Globvest.co.in or give us a call @ 9999259892 and get started! You just need to have a valid PAN Card and hold an NRE/NRO account; you can start investing through us. We at Globvest.co.in, will also get your KYC (Know Your Customer) done, for FREE.

Foreign Account Tax Compliance Act (FATCA) is a US government tax policy to which India is also a signatory. As per this act, the Indian Financial Institutions like Indian Mutual Funds are required to report investment transactions of US Persons and Entities to the US government. These transaction reporting is used by the US government to determine the tax liability of their persons and entities as per their domestic tax policies and laws. Due to this, all Indian Investors including NRIs are required to declare FATCA details at the time of their investments to the Mutual Fund houses. And yes, US/Canada NRIs can invest in indian Mutual Funds.

The following documents are required to invest in Mutual Funds in India:

- Pan Card Copy

- Passport Copy (Front and Back page)

- Foreign Address proof/ Indian Address proof (For ex: if passport has foreign address then provide Indian Address proof)

- Bank Proof (cancelled cheque or latest bank Statement from NRE or NRO Account)

- Person of Indian origin (PIO) or Overseas Citizen of India (OCI) certificates. This is only required for investors who are not Indian Nationals.

You can just upload these simply drop a mail on help@globvest.co.in and we will do the rest.

Taxation for NRIs for investing in Indian Mutual Funds is same as taxation of resident Indians. The only difference is that there is a 10% TDS (Tax Deducted at Source ) for NRIs at the time of redemptions. Equity investments in India are taxed at 15% for short term (less than 1 year of holding) and 10% for the long term (more than 1 year of holding). Debt investments in India are taxed as per the tax slab for the short term (less than 3 years of holding) and at 20% post indexation benefits for the long term (more than 3 years of holding). The tax indexation benefit is a great way to reduce your tax outgo and generate much better returns than Fixed Deposits for NRI clients. India has signed this treaty with the US & Canada, so any tax paid in India can be claimed as relief in the US/Canada tax returns.

NRIs can invest through either NRE or NRO account in Indian Mutual Funds. While creating an account with us, you can choose either of the two options. NRIs who wish to invest through both NRE and NRO account can invest through two separate accounts (one for NRE and other for NRO) by getting in touch with help@globvest.co.in customer care.