What is Term Insurance?

Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified "term" of years. If the insured dies during the time period specified in the policy and the policy is active, or in force, a death benefit will be paid.

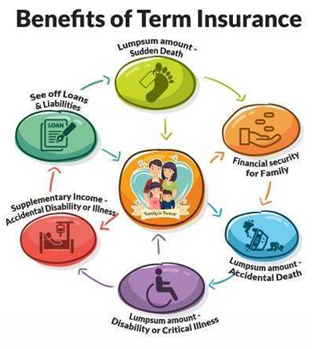

Life comes with an expiry date, which unfortunately is unknown. There are lots of uncertainties in life due to increasing no. of accidents and diseases. So, to combat such unforeseen aspect of our life, we must have a financial backup to take care of our family after us. That’s why Term Insurance is very important, to help our family lead a financially stable life and meet their daily expenses after us.

How to Choose a Term Insurance Plan

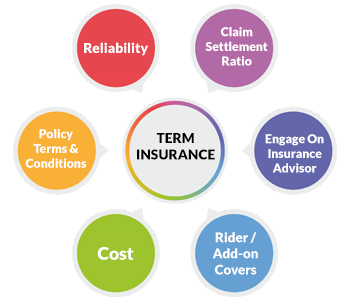

The market is flooded with term insurance policy options, with varying policy terms, benefits and sum assured amounts. Navigating this maze of policies and making sure you choose the one that fits best and meets your requirements is a difficult task.

- Reliability:

When picking an insurance policy, it is always advisable to look at the insurance company’s reputation.

- Claim Settlement Ratio

It is an indicator of the number of claims settled out of every 100 claims received by the company.

- Engage an insurance advisor:

Amid so many companies and insurance products, it can be very difficult to identify and buy right insurance for you. An expert can advise you what, how much, when, where & why to buy Term insurance, basis on various factors like age, income, family stage, health condition, tax liabilities etc. .

- Riders / Add-on covers:

The riders like critical illness, accidental death cover etc. provided by the insurance company in addition to the regular policies are important to be considered.

- Cost:

The amount you would be paying in terms of premium for the protection offered is a key factor in selecting a term insurance policy.

- Policy terms and conditions

It is vital that you read the terms and conditions within the policy document thoroughly before signing the dotted line. This enables you to understand the minute details pertaining to the inclusions and exclusions under the plan.

Eligibility Criteria of Term Insurance

- The minimum age of the policyholder will have to be 18 years old when taking the plan.

- The maximum age at the time of maturity for these policies depends upon Insurer.

- You must be earning to buy Term Insurance

- This may not be mandatory but some insurers may ask you to undergo a medical check-up prior to taking the policy.

Document requirements may also differ from insurer to insurer.

- PAN card

- Identity Proof of like passport, Voter ID card, Aadhaar card, driving license, letter from a public servant

- Proof of age with documents like passport, birth certificate, driving license, PAN card, etc.

- Proof of address with documents like Aadhaar card, Voter ID card, passport.

- Proof of income with documents like Income tax returns, Form 16, employer’s, 3 month’s salary slip

- Recently clicked passport sized photo.